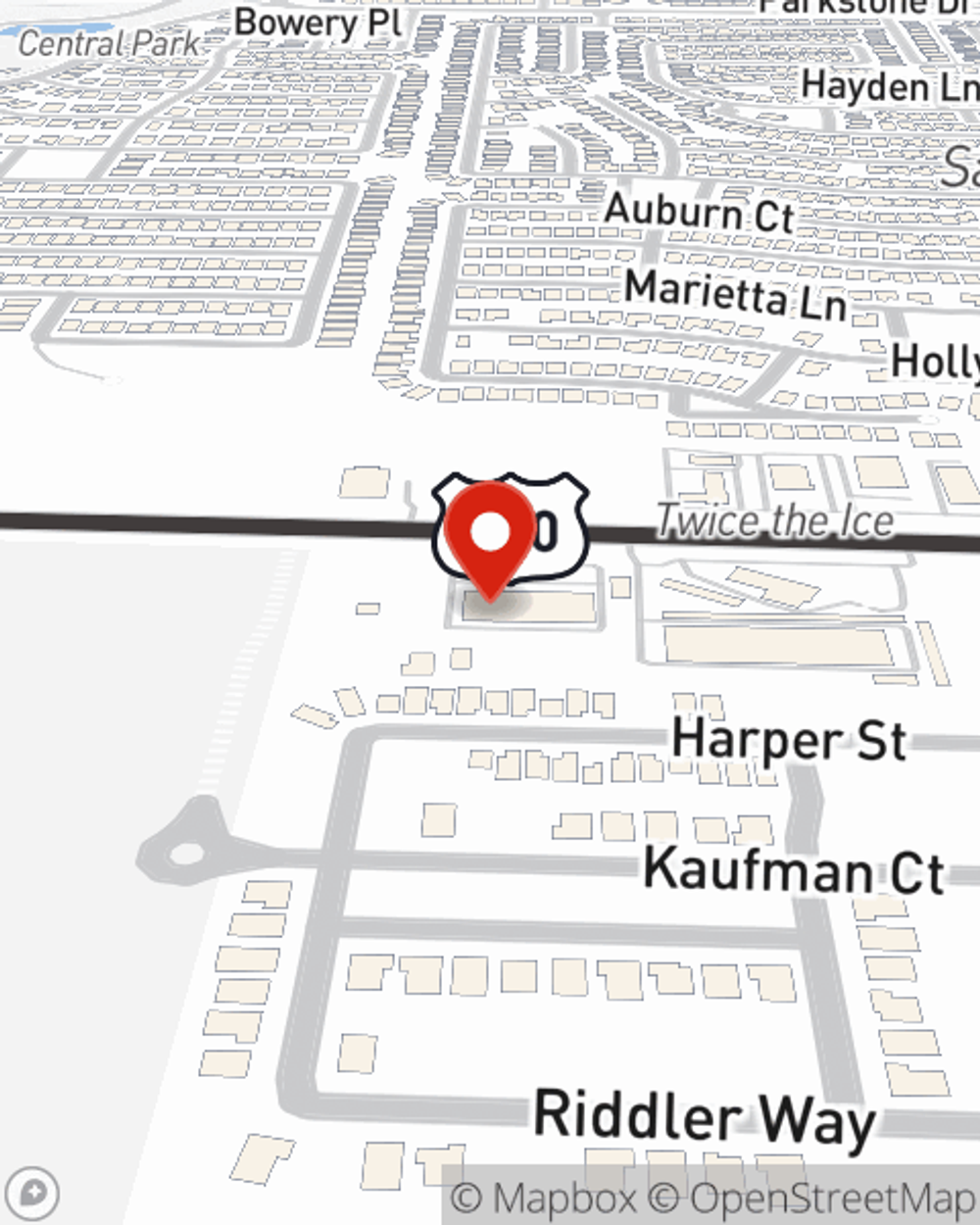

Renters Insurance in and around Aubrey

Your renters insurance search is over, Aubrey

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

- Aubrey

- Cross Roads

- Little Elm

- Frisco

- Prosper

- McKinney

- Holly Hock

- Windsong Ranch

- Denton County

- Denton

- Collin County

- Savannah

- Union Park

- Providence Village

- Oak Point

- Linden Hills

- Creekside

- Paloma Creek

- Braswell High

- Estates at Rockhill

- Panther Creek HS

- PGA of America

- Somerset Park

- Silverado

Insure What You Own While You Lease A Home

Your possessions are valuable and so is their safety. Doing what you can to keep it safe just makes sense! That’s why the most sensible step is getting renters insurance from State Farm. A State Farm renters insurance policy can protect your possessions, from your smartphone to your sports equipment. Unsure how to choose a level of coverage? No problem! Tommy Rosales stands ready to help you evaluate your risks and help select the right policy today.

Your renters insurance search is over, Aubrey

Renting a home? Insure what you own.

State Farm Has Options For Your Renters Insurance Needs

Renting a home makes the most sense for a lot of people, and so is protecting your belongings with insurance. In general, your landlord's insurance might cover repairs for damage to the structure of your rented home, but that doesn't include your personal belongings. Renters insurance helps shield your personal possessions in case of the unexpected.

There's no better time than the present! Call or email Tommy Rosales's office today to help make life go right in your rented home.

Have More Questions About Renters Insurance?

Call Tommy at (940) 387-4512 or visit our FAQ page.

Simple Insights®

Insurance and other tips for college students and their belongings

Insurance and other tips for college students and their belongings

Learn how your homeowners insurance policy can help protect your college student and their belongings while they are living in a residence hall or dorm.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Tommy Rosales

State Farm® Insurance AgentSimple Insights®

Insurance and other tips for college students and their belongings

Insurance and other tips for college students and their belongings

Learn how your homeowners insurance policy can help protect your college student and their belongings while they are living in a residence hall or dorm.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.